General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsWill the stock market go level 3 Wednesday?

Will it drop so low trading stops?

Emile

(33,710 posts)than where I'm at today.

OLDMDDEM

(2,382 posts)Happy Hoosier

(8,851 posts)I think the Trump insanity is mostly priced in now.... the market will go sideways more or less, maybe a bear market, but not a crash. At least that's my guess. I'm still investing in my 401K, but the money I'm putting in my brokerage account is just gonna sit in cash for a while. Not really a market timer, but it seems a sure thing to me that the markwet is just gonna suck this year.

Watchfoxheadexplodes

(3,507 posts)I got that thought 😔

Happy Hoosier

(8,851 posts)Bernardo de La Paz

(53,757 posts)The big funds and banks and brokerages are mostly still touting new highs by the end of this year, though Goldman Sachs and Royal Bank Canada have lowered their estimates and increased their probability assessment of risk of recession.

Judging by headlines on MarketWatch and Barrons, there are lots of articles about stock picks for this or that, Tesla Bull A expects higher prices for reason Y, how to buy defensive stocks, along with articles about tariff jitters and uncertainty. An uptick in jitters articles today, feels like.

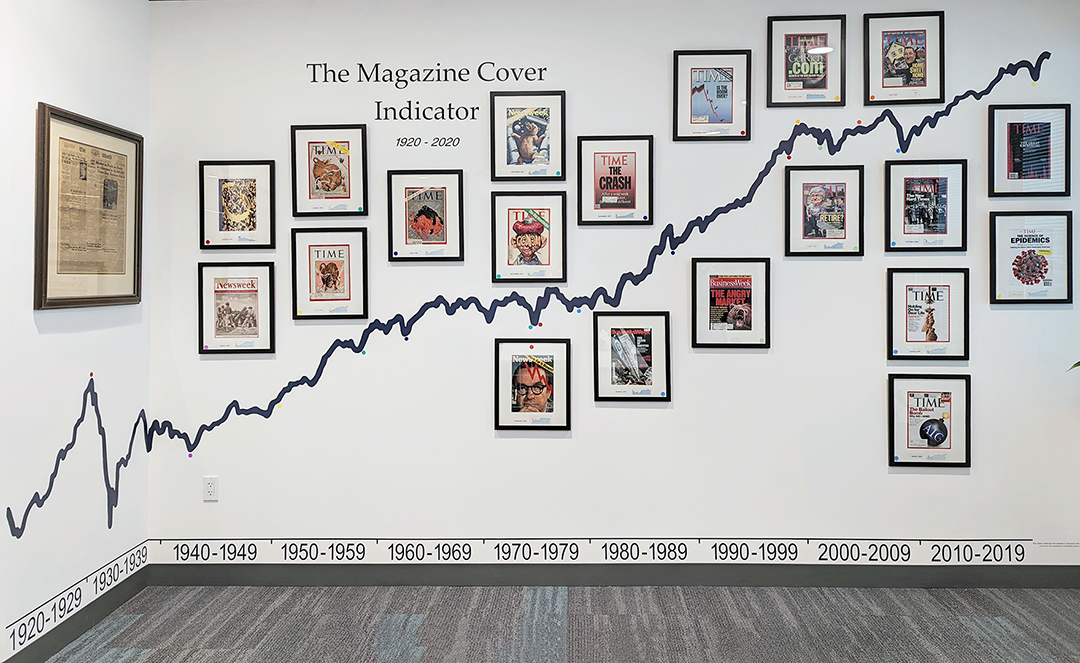

It pays to take a bit of a contrarian stance. In January, there were many articles about a bright future for business with only a few about doubts. That is toppish. I don't know what Business Week (now Bloomberg Businessweek) is doing these weeks, but there was an old trope with a bunch of truth behind it that if its cover declared that there was an ongoing strong bull market, then that was a sign of a top.

They don't have many BusinessWeek covers but they have many others on this fascinating web page with charts and correlations.

https://alphacubedinvestments.com/magazines/

RBC: https://www.rbccm.com/en/story/story.page?dcr=templatedata/article/story/data/2025/03/walking-through-the-math-behind-our-updated-sp-500-forecasts

The big things you need to know:

We’ve lowered our YE 2025 S&P 500 price target to 6,200 from 6,600.

We’ve lowered our 2025 S&P 500 EPS forecast to $264 from $271.

Among other adjustments, our new price target and EPS forecast embed the updated views of RBC’s Economics and Rates strategy team which were released last week.

We have updated our year-end 2025 bear case for the S&P 500, which we’ve lowered from 5,775 to 5,550.

Fourth, some of the vibes we’ve been tracking are starting to look too extreme to us (in terms of their negativity), but others have more room to go lower.

View audio transcript

Bernardo de La Paz

(53,757 posts)Given his proclivities, I don't expect it before the 9:30 am EDT open.

SWBTATTReg

(25,067 posts)think he has unfettered access to tampering w/ the nation's economic engine. I thought that such access to such control was only when we were at/on a war time basis, which we're not. Perhaps one of the many lawsuits out there against the moron are gaining fruit in the Courts running w/ this premise.

Perhaps maybe a stronger message needs to be sent to tRUMP and his stupid morons. Such as a total economic boycott of ALL things across the entire USA. No exceptions. Make it a day where everyone participates, and doesn't buy a single thing, no gas, no dinners/meals out of the house, no shopping anywhere, nothing. Show these thugs just exactly who is boss here (us, the US consumer is who is boss, and no one else, we proved it at one time when they were begging us to spend money some years back, and we need to do this again.

There are some boycotts underway now as we speak, but I'm not sure how effective they are. The Canadian one boycott of all US imports / exports / US made items in Canada seems to be really effective.

Bernardo de La Paz

(53,757 posts)Another idea is to see how long you can go in a week or month before your first real indulgence like a night out or feel-good purchase. Good way to conserve cash as a precaution.

Boycotts, buying strikes, and staycations are good examples of mass action. Readjusting investments is another. Thank you for highlighting the economic mass action of Canadians.

There is hearsay that tRump wants to drive the value of US dollar down to devalue US debt and make US exports cheaper to other countries, further drive up the price of imports.

Downside of that is that foreign investors are (and will more) withdrawing money from investments like US stocks and bonds. More downward pressure on the markets.

Happy Hoosier

(8,851 posts)I'm anticipating an d planning for another 10% drop in the markets. I'm plopping my monthly after-tax savings in cash at my brokerage. If the markets drop another 10% off highs, I'll go in... espoecially if it looks like FDT is cratering.

SWBTATTReg

(25,067 posts)will be some bargains. But I would be very careful, as long as tRUMP has those stupid executive actions, and keeps writing them, thinking that they're the solve all to all of our problems (they're not), he's never going to work w/ Congress or any other entities to fix things or enhance things (it seems that way, and I am figuring that he's going to do another tax thing like he did in his first term, which I don't think is needed, and I agree w/ you, FDT).

The business environment has had plenty of things already going for it. Businesses don't need this sort of thing now. But tRUMP has got it in his mind that he's got to do something, simply because he's thinks it needs something. It doesn't, it just needs a steady hand, no willy nilly crap like he's so prone to doing.

Right now, he's crashed consumer spending. A big chunk of spending that, despite what some think, it did stimulate consumer spending.

So now he's got to fight this, and as the giant boogie man, he's pissed off ALL of our trading partners, both imports and exports. He already knew that these were big economic engines that drive the Economy. What the hell? And he seems to think that factories can be built overnight (and he crashed the Infrastructure Spending initiative too, so no help there, in short, he's f**ked himself (and us too I personally think)).

Bernardo de La Paz

(53,757 posts)I'm surprised it did not go down in December instead of making a pre-top (SP500) Dec 6 and double top Jan 29 and Feb 19. I'm surprised it is not down 20% from December. I got out of stocks entirely Jan. 9th around when it crossed a lower-bound trend line on the chart. But what do I know? Certainly no insider info or political connections or formal education in economics.

ProfessorGAC

(72,131 posts)It's up 1% today

Still down a percent & a half over the last 5 days & 4.2% the last month.

But, nothing going on today to trigger plunge protection.

I would guess if it was going to tank, it would be at least sliding a bit today, not going up.

Bernardo de La Paz

(53,757 posts)We have to expect retracements and such regardless of whether the major trend is bear or bull.

One might imagine that if bullish types were out buying after the first hour bumping up the market, it only makes for a bigger drop Thursday in reaction. I am supposing tRump will release the tariff taxes info after the market on Wednesday, not before or during, but anything is possible.

Also, we can expect only some clarity Wednesday and not much finality / resolution.

ProfessorGAC

(72,131 posts)But I see see the overall drop to not being a true bargain hunter's opportunity.

Especially is the sharps have ant notion of a pst-tariff plunge.

It seems the market is blithely operating on a "business as usual" attitude, which would explain relatively modest swings in a period of obvious uncertainty.

It's like the marketeers aren't paying attention to anything else going on.

But, you could be right. Like I said, I'm just guessing.

Bernardo de La Paz

(53,757 posts)WarGamer

(16,726 posts)onenote

(45,039 posts)Nigrum Cattus

(450 posts)Watching how many "shorts" will be placed.

Big money wins going up or down

Johonny

(23,152 posts)Might be more sideways trading until 2nd qrt reporting. Company guidance likely to be alarming in their next earnings reports.

Bernardo de La Paz

(53,757 posts)I think the market, as evidenced by the main sentiment of middle to upper class investors has not thought through the downsides of everything going on simultaneously and doubts tRump's seriousness. Thus the market is trading around the correction line trying to decide to go up or down, last couple of weeks. I did see a single report headline and paragraph alleging that a notable number of big money investors were net sellers of stocks in early 2025, but I would not give it much weight.

Canadian leaders and people are taking the threats seriously and acting accordingly. But even here the TSX has not declined the way I thought it would by now. However, these are early days and the effects of the tRump cataclysm will be long lasting.

Johonny

(23,152 posts)The same one that told me the tariffs are a bluff, that the tariff inflation will be transitory. This is because companies will rework supply chains to get around tariffs. Okay, but what if basically every trade partner is subject to tariffs? What trade partner are they thinking about supply chains moving to, Mars, the Moon? I think a lot of Wall Street is in denial about Trump's economic plans.

I think a lot of people are hoping for a last minute cancellation like he's done most of the time before.

GreatGazoo

(4,096 posts)This one is fully expected, delayed, expected again, hedged, laddered, algo'd, etc.

My guess is Trump kicks it out 30 days again or softens or both and a relief rally turns into a short squeeze. But I'm not betting on it.

Regardless I like defensive stocks this year no matter what happens on Wednesday -- VZ, GLD, MO, PAA, QYLD, ABBV

GLD ripping on the USD devaluation / uncertainty. https://www.marketwatch.com/investing/fund/gld

Bernardo de La Paz

(53,757 posts)... not realizing just how abnormal things are becoming.

GreatGazoo

(4,096 posts)very orderly run for the exits. In early March all three indexes would drop by the nearly same percentage day after day, about 0.5% Algos drive prices to even numbers which are tied to options trading.

SPY close $560 on 3/10

$555 on 3/11

$550 on 3/13, etc

I follow shipping. I was researching Henry Hudson and that period, 1570 to 1620 and had to learn a ton about shipping to understand Spain vs England vs France, routes to Cathay, piracy, arbitrage, all that. Dang little has changed in 400 years. Shipping is still the middle of the supply chains.

The plan is much more than tariffs -- million-dollar port fees, ship registry stuff, fleet building. What Trump wants to do can be done but it can't be done on Wednesday. You don't just order a fleet of ice breakers and LNG transport ships from Amazon Prime and have them show up in Greenland on Thursday. I lean toward those who believe that this will be a slower transition than the current hysteria conveys.

Trump will want something to start on Wednesday so I'm thinking it will be the least disruptive tariffs. Stuff that can be collected on and the shipments move and while other more critical supply chains have time to reconfigure. And it will be countries that he is mad at: French wine. Canadian food. Canola oil, Canadian soy, wheat and corn. Chinese EVs, solar panels, PPE.

ETA: This guy covers a lot. Too much perhaps but it is indexed and front loaded so the big developments are covered first:

Bernardo de La Paz

(53,757 posts)Algorithms are prevalent, but they don't drive the market. They do search for imbalances, in particular among options, and then play those. But effectively it adds up to a kind of noise cancelling noise, smoothing out market inefficiencies like noise cancelling headphones.

I have in particular watched the percentages comparing the 3 indices day by day and I do not see that "nearly the same percentage day after day". Not at all. Does your floor trader friend have some charts or data analysis on that specific point that you could share with us?

And re the SPY (ETF) theory:

Here are the SPY closes for 2025, rounded to the nearest dollar (from .50 below to .49 above) by spreadsheet. We should expect the result to have substantially more than 20% fall on 0 or 5. Let's see. I count 16 out of 60 closes, or 26 percent. I'd have delve back into statistics to see how relevant that is, but my intuition is that it is close to chance and we need a larger sample.

Rounded

559 556 567 569 575 574 564 565 567 561 567 563 551 559 556 561

576 573 583 577 584 594 585 595 594 597 600 610 613 611 610 610

603 605 605 601 606 604 602 598 602 605 602 605 599 608 610 606

603 598 592 593 582 581 580 589 589 595 592 585

So I did it on a year, with first rounding, then div modulo 5 and then transforming to 1 and 0 and then summing.

I got 53 ending on a 0 or a 5 and that is out of 250 (Apr1 2024 to Mar 31 2025) for a percentage of 21.2 % or effectively chance.

So I think your friend's idea is bogus.

GreatGazoo

(4,096 posts)He is talking about how algo trading is tied to human operators + options trading which uses round numbers. But I still believe the March decline was orderly and steady and I expect that will continue. We may get a relief rally tomorrow or late today but I think the decline continues.

Algos and strike prices at 1:30:32 (and I love how much this guy sounds like Martin Scorsese)