Welcome to DU!

The truly grassroots left-of-center political community where regular people, not algorithms, drive the discussions and set the standards.

Join the community:

Create a free account

Support DU (and get rid of ads!):

Become a Star Member

Latest Breaking News

Editorials & Other Articles

General Discussion

The DU Lounge

All Forums

Issue Forums

Culture Forums

Alliance Forums

Region Forums

Support Forums

Help & Search

S&P 500 closed Tuesday 2/24 at 6890, up 0.8% ## Slight upticks on still very lousy consumer confidence and ADP payrolls [View all]

This discussion thread is pinned.

Last edited Tue Feb 24, 2026, 10:24 PM - Edit history (253)

In the future I will only be doing these twice a week: Tuesday and Friday, unless it's really interesting.10 Year TREASURY YIELD 4.03% on Feb 24, down from 4.09% on Feb 20. It was 4.27% on Feb 3. It was 4.19% on Friday 12/12 (It local-bottomed out at 3.95% 10/22/25, its lowest point since April.)

https://finance.yahoo.com/quote/%5ETNX/

10 Year Treasury price: https://finance.yahoo.com/quote/ZN%3DF/

Bitcoin: $64,086 @ 427p ET Feb 24, down from $68,597 @ 2/21 148p # It was $75,512 @ 6:50 PM ET Feb 3. It was $84,009 @ 944pm ET Friday 1/30. It was $95,401 @ 533p ET 1/16/26, It recently exceeded at last it's end of year 2024 closing level ($93,429), but it's back below the waterline on that metric, , It's in bear market territory, down more than 20% from it's $126,000+ all-time high in October (20% down from $126,000 is $100,800) ACTUALLY, it's down 49% from $126,000 (Cryptocurrencies trade 24/7) https://finance.yahoo.com/quote/BTC-USD/

Next Fed rate decision: March 18 (last was January 28)

CME FedWatch tool (probabilities of various Fed interest rate moves) 1/30: 13% chance of a rate cut), 2/10: 20% chance, 2/13: 9% chance, 2/20: 3% chance

. . . https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html

The S&P 500 closed Tuesday February 24 at 6890, up 0.8% for the day,

and down 0.3% from Friday,

and up 19.1% from the 5783 election day closing level,

and up 14.9% from the inauguration eve closing level,

and up 17.1% since the December 31, 2024 close

and up 0.7% Year-To-Date (since the December 31, 2025 close)

https://finance.yahoo.com/quote/%5EGSPC

(more below on the S&P 500 levels corresponding to the above, and also the Dow)

Market news of the day: https://finance.yahoo.com/

How to find the latest Yahoo Finance "stock market today" report if it's not at the finance.yahoo page (note that the headline displayed there does not include the "Stock Market Today" words, but the article itself does): click on

https://www.google.com/search?q=%22stock+market+today%22+site%3Afinance.yahoo.com&oq=%22stock+market+today%22+site%3Afinance.yahoo.com

If the link doesn't work for you,

Google: "stock market today" site:finance.yahoo.com

First I will briefly cover Monday. Then on to Tuesday

Monday Feb 23

S&P 500 down 1.04%, Dow down 1.66% (822 points), NASDAQ down 1.13%, Russell 2000 down 1.61%

Stock market today: Dow drops 800 points as S&P 500, Nasdaq slide on Trump tariff fears, AI 'scare trade', Yahoo Finance, MONDAY 2/23/26

https://finance.yahoo.com/news/live/stock-market-today-dow-drops-800-points-as-sp-500-nasdaq-slide-on-trump-tariff-fears-ai-scare-trade-210027026.html

US stocks retreated on Monday as investors grappled with the fallout from the Supreme Court's rebuff of President Trump's most sweeping tariffs, while AI disruption fears gripped markets once again.

Growing uncertainty about the global trade landscape is unsettling markets. The Supreme Court's invalidation of many US tariffs on Friday initially fueled trade hopes and buoyed stocks. But Wall Street is reassessing after Trump said Saturday that the US will lift the baseline tariff rate on imports to 15%, effective immediately. ((update - per a report Tuesday 2/24, admin announced 10% --progree))

In a strong response, the EU rejected any hike in tariffs, saying "a deal is a deal" and calling on Washington to clarify the steps it will take.

Meanwhile, the "AI scare trade" resumed on Monday, after Anthropic announced an AI tool designed to automate analysis and tasks typically done by expensive consulting teams. Shares of IBM (IBM) shares sank 13%, while Accenture (ACN) and Cognizant Technology (CTSH) also fell.

Industries across the board, including software, real estate and logistics, have gotten hit over the past several weeks amid concerns that AI tools will disrupt business models and squeeze margins.

Looking ahead, AI chipmaker Nvidia's (NVDA) results on Wednesday are the earnings highlight as the season continues to wind down, and as AI disruption fears swirl. Nvidia shares were a rare green spot for the market on Monday.

https://finance.yahoo.com/news/live/stock-market-today-dow-drops-800-points-as-sp-500-nasdaq-slide-on-trump-tariff-fears-ai-scare-trade-210027026.html

US stocks retreated on Monday as investors grappled with the fallout from the Supreme Court's rebuff of President Trump's most sweeping tariffs, while AI disruption fears gripped markets once again.

Growing uncertainty about the global trade landscape is unsettling markets. The Supreme Court's invalidation of many US tariffs on Friday initially fueled trade hopes and buoyed stocks. But Wall Street is reassessing after Trump said Saturday that the US will lift the baseline tariff rate on imports to 15%, effective immediately. ((update - per a report Tuesday 2/24, admin announced 10% --progree))

In a strong response, the EU rejected any hike in tariffs, saying "a deal is a deal" and calling on Washington to clarify the steps it will take.

Meanwhile, the "AI scare trade" resumed on Monday, after Anthropic announced an AI tool designed to automate analysis and tasks typically done by expensive consulting teams. Shares of IBM (IBM) shares sank 13%, while Accenture (ACN) and Cognizant Technology (CTSH) also fell.

Industries across the board, including software, real estate and logistics, have gotten hit over the past several weeks amid concerns that AI tools will disrupt business models and squeeze margins.

Looking ahead, AI chipmaker Nvidia's (NVDA) results on Wednesday are the earnings highlight as the season continues to wind down, and as AI disruption fears swirl. Nvidia shares were a rare green spot for the market on Monday.

--- SCROLLING DOWN THE PAGE, Monday February 23 -----

Stocks fall as AI scare trade resumes, Trump tariff uncertainty emerges

BofA: 'Misinformation' around Blue Owl makes the stock an attractive buy

Blue Owl Capital's (OBDC) shares have been punished over the last week after news that the firm was suspending redemptions from one of its private credit funds. The move prompted a renewed surge in worries around private credit markets, and shares have dropped roughly 8% over the past month.

Gold climbs to three week high, silver jumps on tariff uncertainty

Treasury yields fall as investors turn to bonds amid flight to safety

Payments stocks get dragged into the risk-off wave ((payments and e-commerce stocks -progree))

Hedge funds sell global stocks at fastest pace since 'Liberation Day' meltdown

Novo's stock falls as obesity drug falls short against Lilly's in trial

From Wednesday but worth another day in the highlights --

BofA: Corporate profits rise while labor income falls, 'fueling K-shaped economy'

*There's a graph from 2006 on: Wages and salaries as a percent of GDP, compared to Corporate profits as a percent of GDP

The wages and salaries, at about 7.4% of GDP in the latest point on the graph, is lower than any point on the graph, per progreerian eyeballs

Tuesday February 24

S&P 500: +0.77%, Dow +0.76% (370 points), NASDAQ +1.04%,

10Y TREASURY 4.03% +0.00,

Bitcoin: $64,086 @ 427p ET

Stock market today: Dow, S&P 500, Nasdaq jump as software leads AI relief rally ahead of Nvidia earnings, Yahoo Finance, Tuesday, 2/24/26

https://finance.yahoo.com/news/live/stock-market-today-dow-sp-500-nasdaq-jump-as-software-leads-ai-relief-rally-ahead-of-nvidia-earnings-210010666.html

US stocks rose Tuesday, with software stocks leading the charge as Wall Street as worries over AI disruptions eased ahead of Nvidia (NVDA) earnings this week.

. . . The tech-heavy Nasdaq Composite (^IXIC) gained about 1% as AMD (AMD) shares surged after the chipmaker entered a deal to provide Meta (META) with a huge amount of GPUs for the Facebook owner's AI build-out.

The rebound follows a sharp sell-off on Monday as investors grappled with renewed concerns that rapid advances in AI could disrupt broad swaths of corporate America.

That put the spotlight on Anthropic's (ANTH.PVT) virtual event on Tuesday morning, featuring updates to its AI tools and Claude chatbot for companies. The company announced partnerships with several software companies, including Salesforce (CRM), FactSet (FDS), and DocuSign (DOCU), sparking rallies in their respective stocks.

All eyes will be on AI chip heavyweight Nvidia when it posts quarterly results on Wednesday after the market close.

Meanwhile, worries of a revived trade war are still keeping markets on edge, after President Trump's new 10% global tariff took effect on Tuesday. Investors will listen closely to Trump's State of the Union address later Tuesday for hints on his trade policy as he lays out his view of the economy.

https://finance.yahoo.com/news/live/stock-market-today-dow-sp-500-nasdaq-jump-as-software-leads-ai-relief-rally-ahead-of-nvidia-earnings-210010666.html

US stocks rose Tuesday, with software stocks leading the charge as Wall Street as worries over AI disruptions eased ahead of Nvidia (NVDA) earnings this week.

. . . The tech-heavy Nasdaq Composite (^IXIC) gained about 1% as AMD (AMD) shares surged after the chipmaker entered a deal to provide Meta (META) with a huge amount of GPUs for the Facebook owner's AI build-out.

The rebound follows a sharp sell-off on Monday as investors grappled with renewed concerns that rapid advances in AI could disrupt broad swaths of corporate America.

That put the spotlight on Anthropic's (ANTH.PVT) virtual event on Tuesday morning, featuring updates to its AI tools and Claude chatbot for companies. The company announced partnerships with several software companies, including Salesforce (CRM), FactSet (FDS), and DocuSign (DOCU), sparking rallies in their respective stocks.

All eyes will be on AI chip heavyweight Nvidia when it posts quarterly results on Wednesday after the market close.

Meanwhile, worries of a revived trade war are still keeping markets on edge, after President Trump's new 10% global tariff took effect on Tuesday. Investors will listen closely to Trump's State of the Union address later Tuesday for hints on his trade policy as he lays out his view of the economy.

--- SCROLLING DOWN THE PAGE, Tuesday February 24 -----

Software gets a bounce, but the chart isn’t forgiven

Software is finally bouncing. The sector is clawing back steep losses that have come in seemingly relentless waves — the latest hit Monday, with traders spooked by the now-famous Citrini Research paper.

The good news: Anthropic (ANTH.PVT) is going out of its way to sell the “we partner with software” story, highlighting Claude tie-ups with Thomson Reuters (TRI), FactSet (FDS), Salesforce (CRM) via Slack, and DocuSign (DOCU) across what it calls “work surfaces.”

The earlier investor read was darker — that Claude was coming for the whole workflow layer in corporate America.

. . .

Still, today’s sea of green doesn’t erase the damage. Most names are still down double digits since the early-February “AI scare” flush.

The good news: Anthropic (ANTH.PVT) is going out of its way to sell the “we partner with software” story, highlighting Claude tie-ups with Thomson Reuters (TRI), FactSet (FDS), Salesforce (CRM) via Slack, and DocuSign (DOCU) across what it calls “work surfaces.”

The earlier investor read was darker — that Claude was coming for the whole workflow layer in corporate America.

. . .

Still, today’s sea of green doesn’t erase the damage. Most names are still down double digits since the early-February “AI scare” flush.

Goldman Sachs warns AI-fueled layoffs could raise the unemployment rate this year

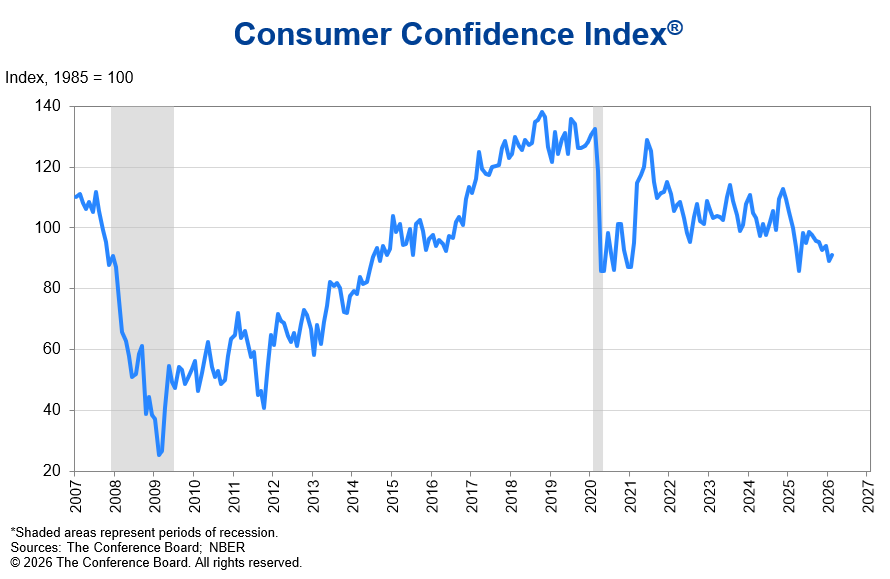

Consumer confidence rises in February, but the trend is 'pretty disturbing,' economist says

"Overall, the trend is pretty disturbing," The Conference Board senior US economist Yelena Shulyatyeva told Yahoo Finance. "Consumers continue to ... think that jobs are really hard to get. Month to month, there are drops and improvements, but the trend overall is to the downside."

More on Consumer Confidence in Calendar section below

Fed Gov. Lisa Cook: Standard Fed policy may struggle to counteract AI-driven unemployment

The article has comments from several other Fed big-wigs

Waymo expands robotaxi service to Dallas, Houston, San Antonio, and Orlando

JPMorgan Chase (JPM) CEO Jamie Dimon warns markets resemble pre-financial crisis era: 'I see a couple of people doing some dumb things'

=============================================

=============================================

=============================================

=============================================

CALENDAR

Recent and Coming Up, Reports (I'm also keeping February 16 and later ones for now, I put the older ones in reply #1

https://www.marketwatch.com/economy-politics/calendar

See Reply #1 to this thread for reports prior to February 16.

The government reports are all seasonally adjusted, as are most, if not all, of the non-government reports the media covers, so please don't post comments about how the numbers look good (or not as bad as expected) only because of Christmas season hires or Christmas shopping. Or that it's warming up and people are beginning spring shopping already -- seasonal factors like that have been adjusted for

LAST WEEK'S REPORTS (Feb 16-20) FOLLOWED BY THIS WEEK'S REPORTS (FEB 23-27) FOLLOWED BY NEXT WEEK'S CALENDAR (MAR 2-6)

I tried putting last week's report at the end so people don't have to scroll through them to see this week's reports. But it got to be confusing and harder to find things, so for now, it's all in chronological order.

LAST WEEK'S REPORTS (FEB 16-20)

@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@

MONDAY FEB 16

None scheduled, President's Day holiday

TUESDAY FEB 17

Nothing

WEDNESDAY FEB 18

# Housing Starts for November and December

Housing starts jump to 5-month high in December

Go to Stock Market Today https://finance.yahoo.com/news/live/stock-market-today-dow-sp-500-gain-for-3rd-straight-day-nasdaq-jumps-as-traders-brush-aside-ai-worries-210052721.html

and scroll down the page quite a ways, or search the page for "housing starts"

Yes, I wish Yahoo would give these articles their own URL.

The number of new single-family homes under construction in December hit an annualized rate of 1.4 million homes, up 6.2% from November and ahead of forecasts for an annualized rate of 1.32 million homes, according to data from the Census Bureau. This pace of building, however, is still 7.3% below December 2024.

This report followed Tuesday's read on homebuilder confidence from the NAHB, which showed sentiment fell by another point to 36 this month, the lowest reading since September.

This report followed Tuesday's read on homebuilder confidence from the NAHB, which showed sentiment fell by another point to 36 this month, the lowest reading since September.

**FRED graph shown in the article, graph is titled: "New Privately-Owned Housing Units Started, Total Units" from 2016 onward

# Building Permits for November and December

December was 1.32 million vs. 1.31 million expected and 1.27 million previously, according to https://www.marketwatch.com/economy-politics/calendar

# Durable Goods Orders for December

Durable goods orders were down 1.4% in December vs. down 2.0% expected, and +5.4% previously according to https://www.marketwatch.com/economy-politics/calendar . I believe these are seasonally adjusted. I don't have an explanation, I haven't looked for an article.

# Industrial Production and Capacity Utilization for January

Go to Stock Market Today https://finance.yahoo.com/news/live/stock-market-today-dow-sp-500-gain-for-3rd-straight-day-nasdaq-jumps-as-traders-brush-aside-ai-worries-210052721.html

and scroll down the page quite a ways, or search the page for "industrial production"

Yes, I wish Yahoo would give these articles their own URL.

US industrial production grew in January by widest monthly margin since March 2025 (+0.7%. It was the largest month-on-month percentage increase since March 2025,

Compared to a year ago, industrial production and manufacturing activity were up 2.3% and 2.4%.

# Minutes of Fed's January FOMC meeting

THURSDAY FEB 19

# Leading economic index for December Conference Board (non-governmental)

US leading indicators forecast slow start to 2026, Wall St. Journal via MSN (no paywall), 2/17/26

https://www.msn.com/en-us/money/markets/us-leading-indicators-forecast-slow-start-to-2026/ar-AA1WG60g

ULTIMATE SOURCE: https://www.conference-board.org/topics/us-leading-indicators/index.cfm

# Unemployment insurance claims

US weekly jobless claims fall more than expected amid labor market stability (dropped 23k to 206k in week ending Feb 14 ## Continuing claims week ending Feb 7 ROSE 17k to 1.869 M), Reuters, 2/19/26

https://finance.yahoo.com/news/us-weekly-jobless-claims-fall-134542016.html

. . .continuing claims suggested that laid-off workers were experiencing difficulties finding new positions.

The median duration of unemployment is near four-year highs. The lack of hiring has significantly impacted recent college graduates, who because of no or limited work history, cannot file for unemployment benefits and are not captured in the claims data.

* SOURCE URL: The CURRENT one is always at: https://www.dol.gov/ui/data.pdf

This report's permalink: https://www.dol.gov/newsroom/releases/eta/eta20260219

* Permalinks for the current one and recent previous ones: https://www.dol.gov/newsroom/releases

. . . and search the page for "Unemployment Insurance Weekly Claims Report"

# U.S. trade deficit for December (the Commerce Dept)

U.S. trade deficit slipped to $901 billion last year amid Trump tariffs, AP, 2/19/26

https://finance.yahoo.com/news/u-trade-deficit-slipped-901-134134850.html

From $904 billion in 2024 to $901 B in 2025.

The trade gap surged from January-March as U.S. companies tried to import foreign goods ahead of Trump’s taxes, then narrowed most of the rest of the year.

Analysis: These two new economic numbers blew a hole in Trump’s rosy narrative, CNN, 2/21/26

https://www.msn.com/en-us/money/markets/analysis-these-two-new-economic-numbers-blew-a-hole-in-trump-s-rosy-narrative/ar-AA1WNbxe

#1 Trade balance, #2 GDP growth (see Friday on GDP)

# Advanced U.S. trade balance in goods for December

See above AP story

# Mortgages rates

Mortgage rates drop to lowest level in nearly 4 years

https://finance.yahoo.com/personal-finance/mortgages/article/mortgage-rates-drop-to-lowest-level-in-nearly-4-years-110045487.html

FRIDAY FEB 20

# GDP Q4 FIRST ESTIMATE

2.5% annualized growth expected, 1.4% is what happened according to the Commerce Department's Bureau of Economic Analysis (BEA)

Q3 was 4.4% annualized rate (I know I know, but the AI spending counts as GDP, even if it produces nothing useful)

Yes, the reported GDP numbers are inflation-adjusted

Full year GDP's: 2024: 2.8%. 2025: 2.2%

LBN Thread: https://www.democraticunderground.com/10143619093

ULTIMATE SOURCE:

. . . https://bea.gov/data/gdp/gross-domestic-product

. . . https://bea.gov/news/current-releases

. . . https://bea.gov/news/2026/gdp-advance-estimate-4th-quarter-and-year-2025

Analysis: These two new economic numbers blew a hole in Trump’s rosy narrative, CNN, 2/21/26

https://www.msn.com/en-us/money/markets/analysis-these-two-new-economic-numbers-blew-a-hole-in-trump-s-rosy-narrative/ar-AA1WNbxe

#1 Trade balance, #2 GDP growth (see Thursday on trade balance)

# PCE Inflation for December - Fed's favorite inflation gauge

Expected: month-over-month: 0.3%, year-over-year: 2.8% (both numbers same as November's)

What happened: month-over-month: regular PCE (includes food and energy) +0.4%

Core PCE (doesn't include food or energy): +0.4%

12 month average (year-over-year): regular PCE: +2.9%, core PCE: +3.0%

LBN thread (this leads off with the GDP, but also includes PCE inflation): https://www.democraticunderground.com/10143619093

GRAPHS: rolling averages of 3 months and 12 months. And month-over-month bar chart. Both regular and core:

. . . https://www.democraticunderground.com/?com=view_post&forum=1014&pid=3619273

This inflation gauge fully includes substitution effects, so for example if beef prices are way up and a lot of consumers switch to turkey necks, this inflation gauge will show a subdued rise or even a drop in the meat price index. But I suspect the Fed likes it because it tends to produce a lower inflation rate than the CPI.

* SOURCE URLS:: https://www.bea.gov/data/income-saving/personal-income

. . . CURRENT RELEASE: https://www.bea.gov/news/2026/personal-income-and-outlays-december-2025

. . . Full Release and Tables: https://www.bea.gov/sites/default/files/2026-02/pi1225.pdf

. . . PCE DATA SERIES: https://fred.stlouisfed.org/series/PCEPI

. . . CORE PCE DATA SERIES: https://fred.stlouisfed.org/data/PCEPILFE

# Personal Income and Spending for December

* SOURCE URLS:: https://www.bea.gov/data/income-saving/personal-income

. . . CURRENT RELEASE: https://www.bea.gov/news/2026/personal-income-and-outlays-december-2025

. . . Full Release and Tables: https://www.bea.gov/sites/default/files/2026-02/pi1225.pdf

# S&P flash U.S. services PMI for February

# S&P flash U.S. manufacturing PMI for February

# New home sales for November and December

# Consumer sentiment (prelim) for February

Consumer sentiment in February shows high prices weigh on US households, but Supreme Court could offer relief, Yahoo Finance, 2/20/26 https://finance.yahoo.com/news/consumer-sentiment-in-february-shows-high-prices-weigh-on-us-households-but-supreme-court-could-offer-relief-161122277.html

The University of Michigan's Index of Consumer Sentiment for February came in at 56.6, up 0.4% from January, but below last year's level of 64.7. The small increase was lower than the 57.2 reading expected by economists. (Be sure to look at the graph that shows the scale of the teeny tiny up-tick still leaving it at incredibly low levels historically.

ULTIMATE SOURCE: https://www.sca.isr.umich.edu/

GRAPH, 10 years: https://www.sca.isr.umich.edu/files/chicsr.pdf

GRAPH, 50 years: https://www.sca.isr.umich.edu/files/chicsh.pdf

THIS WEEK'S REPORTS/CALENDAR (FEB 23-27)

@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@

MONDAY FEB 23 (REPORTS)

# Factory orders December

-0.7%. ; +0.2% expected. ; Previous time: +2.7%. Year-over-year: +3.7%

US factory orders fall in December on commercial aircraft bookings, Reuters, 2/23/26

https://finance.yahoo.com/news/us-factory-orders-fall-december-154841615.html

New orders for U.S. factory goods fell in December amid a sharp decline in commercial aircraft bookings, but demand elsewhere was strong, partly driven by robust investment in artificial intelligence.

Factory orders dropped 0.7% after an unrevised 2.7% increase in November, the Commerce Department's Census Bureau said on Monday.

Economists polled by Reuters had forecast factory orders would slip 0.6%. Orders advanced 3.7% on a year-on-year basis in December. The report was delayed by last year's government shutdown,

. . . Manufacturing, which accounts for 10.1% of the economy, has been hamstrung by President Donald Trump's sweeping tariffs, which business leaders say have raised costs for factories and consumers. But some sections have been supported by the rapid adoption of AI.

https://finance.yahoo.com/news/us-factory-orders-fall-december-154841615.html

New orders for U.S. factory goods fell in December amid a sharp decline in commercial aircraft bookings, but demand elsewhere was strong, partly driven by robust investment in artificial intelligence.

Factory orders dropped 0.7% after an unrevised 2.7% increase in November, the Commerce Department's Census Bureau said on Monday.

Economists polled by Reuters had forecast factory orders would slip 0.6%. Orders advanced 3.7% on a year-on-year basis in December. The report was delayed by last year's government shutdown,

. . . Manufacturing, which accounts for 10.1% of the economy, has been hamstrung by President Donald Trump's sweeping tariffs, which business leaders say have raised costs for factories and consumers. But some sections have been supported by the rapid adoption of AI.

TUESDAY FEB 24 (REPORTS)

# ADP NER Pulse private payrolls weekly estimate - For the four weeks ending February 7, 2026, private employers added an average of 12,750 jobs a week. It was the fourth straight week of strengthening job gains.

SOURCE: https://www.adpresearch.com/ and search for Pulse

https://www.adpresearch.com/what-happened-to-labor-market-dynamism/ search for "NER Pulse" to see the graph

GRAPH:

Multiplying by 365 / (12*7) to "monthesize it" to the average month: 55,400

Compare to latest from BLS: 172,000 PRIVATE SECTOR jobs added in January

. . . https://www.bls.gov/news.release/empsit.t17.htm

Economy Group Thread: https://www.democraticunderground.com/1116101728

# S&P Case-Shiller home price index (20 cities), December

Up 1.4%, same as November, which was also up 1.4%.

# Consumer confidence, February

91.2. 88.6 was expected. Previous time: 89.0.

From the source: https://www.conference-board.org/topics/consumer-confidence/

The Conference Board Consumer Confidence Index® increased by 2.2 points in February to 91.2 (1985=100), from an upwardly revised 89.0 in January. The Present Situation Index—based on consumers’ assessment of current business and labor market conditions—decreased by 1.8 points to 120.0 in February. The Expectations Index—based on consumers’ short-term outlook for income, business, and labor market conditions—rose by 4.8 points to 72.0. The cutoff for preliminary results was February 17, 2026.

For graphs, click above link -- the uptick is almost imperceptible. It remains at about the same level as it averaged in the first 9 months of the pandemic

WEDNESDAY FEB 25 (CALENDAR)

NVIDIA's earnings expected around 4:30 PM ET

THURSDAY FEB 26 (CALENDAR)

# Unemployment insurance claims

FRIDAY FEB 27 (CALENDAR)

# PPI Producer Price Index aka wholesale prices, January - last time the month-over-month was a whopping 0.5%, that's roughly a 6% annualized rate, and the year over year was 3.0% (the core PPI year-over-year was 3.5%). The Krasnov Krasnov! Brigade was eerily silent about that one.

NEXT WEEK'S CALENDAR (MAR 02-06)

@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@

MONDAY MARCH 2

# S&P final U.S. manufacturing PMI Feb.

# ISM manufacturing Feb

TUESDAY MARCH 3

Nothing

WEDNESDAY MARCH 4

# ADP private sector employment (non-govt) Feb.

# S&P final U.S. services PMI Feb.

# ISM services Feb.

# Fed Beige Book

THURSDAY MARCH 5

# Initial jobless claims week ending Feb. 28

# U.S. productivity, Q4

# Import price index, Feb.

FRIDAY MARCH 6

# Big "First Friday" BLS jobs report headlining non-farm payrolls and unemployment rate

The full calendar: https://www.marketwatch.com/economy-politics/calendar

Revised release dates for Bureau of Labor Statistics reports: https://www.bls.gov/bls/2025-lapse-revised-release-dates.htm

BEA.GOV news release schedule (they produce reports on the GDP, Retail Sales, PCE Inflation (the Fed's favorite inflation gauge), and Personal Consumption and Income: https://www.bea.gov/news/schedule

ADP NER Pulse (private payrolls weekly update): Is every Tuesday. The ultimate source: https://www.adpresearch.com/

and look for "NER Pulse"

Archives of previous reports

The monthly payroll employment reports from the BLS are archived at Archived News Releases (https://www.bls.gov/bls/news-release/ ). In the list up at the top, under Major Economic Indicators, select Employment Situation ( https://www.bls.gov/bls/news-release/empsit.htm ) . That opens up links to reports going back to 1994. (Includes CPI, ECI, many others)

Unemployment insurance claims archives: https://oui.doleta.gov/unemploy/claims.asp . If that doesn't work, start with https://oui.doleta.gov/unemploy/claims_arch.asp and click on "Weekly Claims Data" near the very bottom.

BEA's Data Archive https://www.bea.gov/news/archive

--------------------------

Erika McEntarfer (fired former BLS Commissioner) "Person who was fired here - you should still trust BLS data." - The agency is being run by the same dedicated career staff who were running it while I was awaiting confirmation from the Senate. And the staff have made it clear that they are blowing a loud whistle if there is interference." https://www.democraticunderground.com/?com=view_post&forum=1014&pid=3614986

=============================================

=============================================

=============================================

=============================================

The S&P 500 closed Tuesday February 24 at 6890, up 0.8% for the day,

and down 0.3% from Friday,

and up 19.1% from the 5783 election day closing level,

and up 14.9% from the inauguration eve closing level,

and up 17.1% since the December 31, 2024 close

and up 0.7% Year-To-Date (since the December 31, 2025 close)

S&P 500

# Election day close (11/5/24) 5783

# Last close before inauguration day: (1/17/25): 5997

# 2024 year-end close (12/31/24): 5882

# Trump II era low point (going all the way back to election day Nov5): 4983 on April 8

# 2025 year-end close (12/31/25): 6845

# October 28 all-time-high: 6890.90, surpassed by December 24's all-time high of 6932.00

# Several market indexes: https://finance.yahoo.com/

# S&P 500: https://finance.yahoo.com/quote/%5EGSPC/

https://finance.yahoo.com/quote/%5EGSPC/history/

# S&P 500 futures: https://finance.yahoo.com/quote/ES%3DF/

Bitcoin

Bitcoin ended 2024 at $93,429. https://finance.yahoo.com/quote/BTC-USD/

Bitcoin's all-time interday high: 126,198 on Oct. 6

Bitcoin's all-time closing high: 124,753 on Oct 6. (that's what Yahoo Finance shows, but cryptocurrencies trade 24/7)

https://finance.yahoo.com/quote/BTC-USD/history/

========================================================

I'm not a fan of the DOW as it is a cherry-picked collection of just 30 stocks that are price-weighted, which is silly. It's as asinine as judging consumer price inflation by picking 30 blue chip consumer items, and weighting them according to their prices. But since there is an automatically updating embedded graphic, here it is. It takes several, like 6 hours, after the close for it to update, like about 10 PM EDT.

(If it still isn't updated, try right-clicking on it and opening in a new tab. #OR# click on https://finance.yahoo.com/quote/%5EDJI/ ).

The Dow closed Monday at 48,804, and it closed Tuesday at 49,175, a rise of 0.8% (370 points) for the day

https://finance.yahoo.com/

DOW: https://finance.yahoo.com/quote/%5EDJI/

. . . . . . https://finance.yahoo.com/quote/%5EDJI/history/

DOW

# Election day close (11/5/24) 42,222

# Last close before inauguration day: (1/17/25): 43,488

# 2024 year-end close (12/31/24): 42,544

# 2025 year-end close (12/31/25): 48,063

DJIA means Dow Jones Industrials Average. It takes about 6 hours after the close to update, so check it after 10 PM EDT. Sometimes it takes a couple days (sigh)

I don't have an embeddable graph for the S&P 500, unfortunately, but to see its graph, click on https://finance.yahoo.com/quote/%5EGSPC/

While I'm at it, I might as well show Oil and the Dollar:

Crude Oil

US Dollar Index (DX-Y.NYB)

If you see a tiny graphics square above and no graph, right click on the square and choose "load image". There should be a total of 3 graphs. And remember that it typically takes about 6 hours after the close before these graphs update.

🚨 ❤️ 😬! 😱 < - - emoticon library for future uses

20 replies

= new reply since forum marked as read

Highlight:

NoneDon't highlight anything

5 newestHighlight 5 most recent replies

= new reply since forum marked as read

Highlight:

NoneDon't highlight anything

5 newestHighlight 5 most recent replies

S&P 500 closed Tuesday 2/24 at 6890, up 0.8% ## Slight upticks on still very lousy consumer confidence and ADP payrolls [View all]

progree

Mar 2025

OP

Kicking: update for Thurs. March 6 close. The "Trump Trade" is back underwater after losing 1.8% for the day (S&P 500)

progree

Mar 2025

#2

Kicking: Update: S&P 500 closed Friday at 5770, up 0.5% for the day but still below the election day close

progree

Mar 2025

#3

Update: S&P 500 closed Monday 3/10 at 5615, down 2.7% for the day and 2.9% below the election day close

progree

Mar 2025

#4

Update: S&P 500 closed Tuesday 3/11 at 5572, down 0.8% for the day, briefly fell into correction territory

progree

Mar 2025

#5

S&P 500 closed Wednesday 3/12 at 5599, up 0.5% for the day, but down 3.2% since election day

progree

Mar 2025

#6

Update: S&P 500 closed Thursday at 5522, down 1.4% for the day, and MORE THAN 10% down from the all-time high

progree

Mar 2025

#7

Update: S&P 500 closed Friday at 5639, up 2.1% for the day, and down 2.5% since election day

progree

Mar 2025

#8

Update: S&P 500 closed Monday at 5675, up 0.6% for the day, and down 1.9% since election day

progree

Mar 2025

#9

Update: S&P 500 closed Tuesday at 5615, down 1.1% for the day, and down 2.9% since election day

progree

Mar 2025

#10

S&P 500 closed Tuesday 3/25 at 5777, up 0.2% for the day, down 0.1% since election day, down 6.0% from ATH

progree

Mar 2025

#11